ICYMI: Former U.S. Sen. Pat Toomey Discusses Debanking, Federal Solutions to Rein in Government Overreach During Capitol Hill Event

May 5, 2025

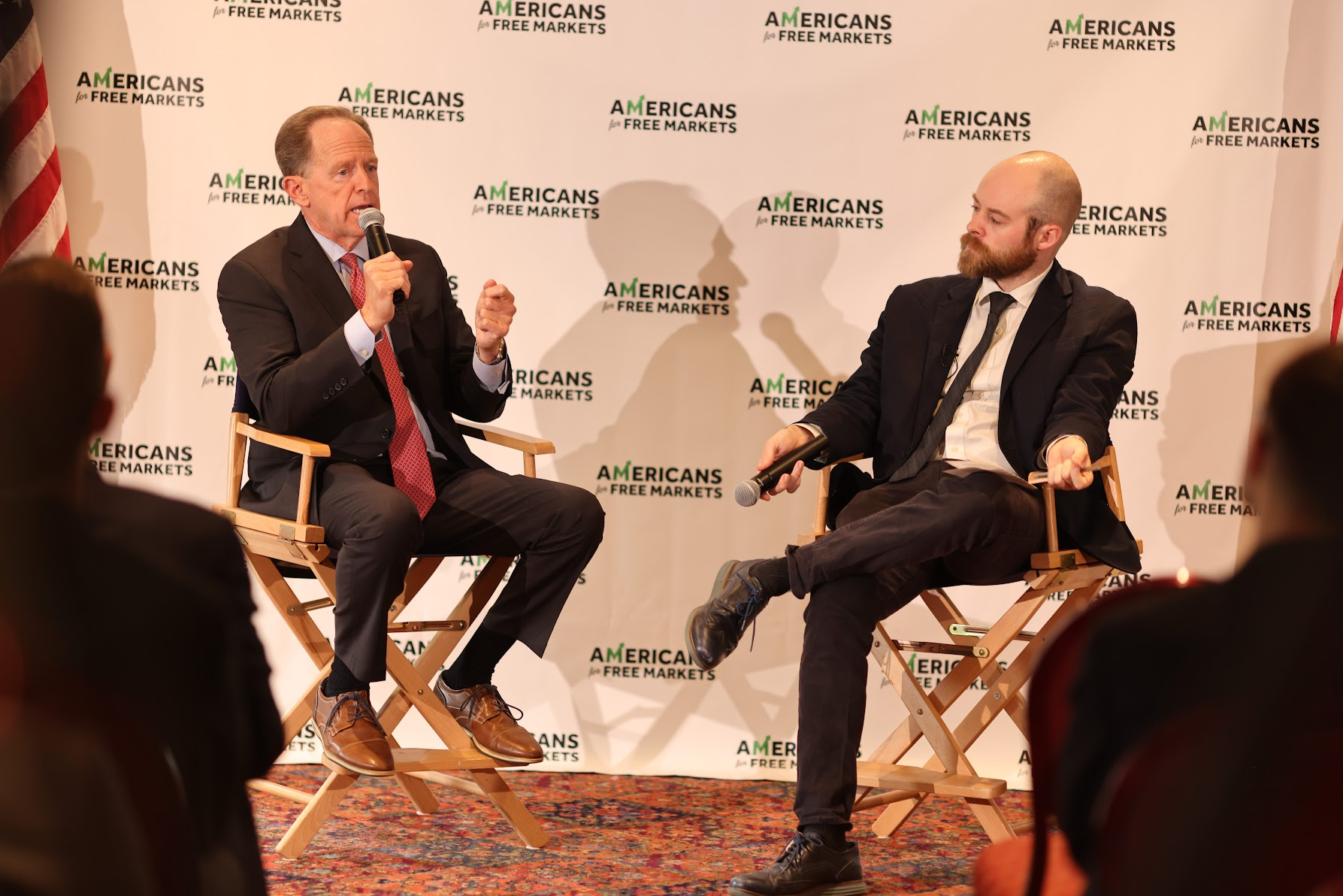

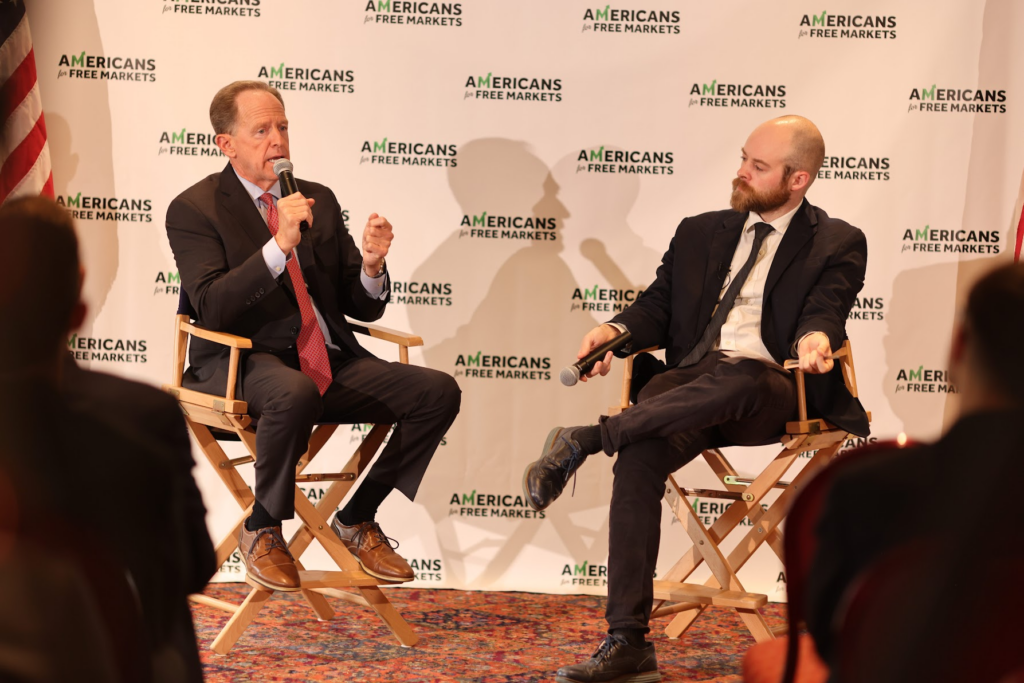

In case you missed it, Americans for Free Markets hosted a fireside chat between former U.S. Senator Pat Toomey and Punchbowl News’ Brendan Pedersen last week on Capitol Hill, where they discussed a range of pressing economic and regulatory topics.

On debanking and the need for federal solutions to rein in government overreach, Sen. Toomey said during the event, “Debanking has been very real. This is not a made-up thing… The important thing in my mind is that it is a completely inappropriate government-sponsored abuse of regulatory powers,” then delved into the “excessively broad, often vague regulations” that led to this.

On what Congress should be focused on, Sen. Toomey expressed the need for federal lawmakers to codify into law legislation like the FIRM Act, noting that “the legislation that Senate Banking Committee has reported out is a huge step in the right direction. That’s a lot better than a patchwork of state laws.”

Sen. Toomey acknowledged the work that regulators have done so far on debanking and what’s ahead, remarking, “The regulators, the OCC, the FDIC, the Fed have withdrawn earlier guidance, and they have made it clear that they are not in the business of deciding who’s worthy of having a bank account and who’s not based on what industry you’re in. This is real progress, but there’s still a ways to go.”

On progress in the 119th Congress so far, Sen. Toomey also gave kudos to Senate Banking Committee Chairman Senator Tim Scott, saying he is doing a “great job,” particularly around his leadership in moving legislation forward that would rein in federal regulators from using vague regulatory standards like “reputational risk” to stifle businesses they disfavor.

“They have done a very good job of processing the nominees, getting them through committee… He’s done a good job with the FIRM Act, which is the legislation we alluded to earlier, which takes away reputational risk from being abused by regulators. That’s very constructive… I think that’s a pretty good track record for this early on,” Toomey continued.

Held at the Capitol Hill Club in Washington, D.C., the private, invite-only event convened congressional staff, policy experts and industry leaders. The conversation explored a range of topics impacting the financial system and our economy more broadly, including the current debanking debate, crypto policy, the evolving role of financial regulators, current trade economics and the need for congressional oversight of federal regulators to protect free markets and private enterprise. Senator Toomey, who previously served as the Senate Banking Committee Ranking Member, offered an experienced perspective on the challenges and opportunities facing the banking sector, stressing the need for clear, national standards to avoid a confusing patchwork of state regulations.

Following the discussion, guests networked and reflected on the evening’s key insights and aligned on shared goals for promoting market-driven policy. This event aligns with Sen. Toomey’s recent op-ed in Newsweek entitled “Washington Must Continue to Rollback Democrat-Era Financial Regulatory Abuses.”